Funding for in-home care can be complex and varies depending on individual circumstances and available resources.

Key funding sources include:

- Medicare: Medicare covers home healthcare services that are medically necessary and prescribed by a physician. This coverage is not limited to a specific number of visits, but the home care agency and Medicare regularly evaluate the patient’s condition and needs to determine the duration of coverage.

- Medicaid: Medicaid, a program for low-income individuals, covers both non-medical home care and home healthcare services to help people remain in their homes. However, Medicaid rules and eligibility vary from state to state. In Illinois, Medicaid provides Home and Community Based Services (HCBS), which can be covered under Regular Medicaid, Medicaid Waivers, or the Community First Choice Option (CFCO).

- Veterans Benefits: Veterans may be eligible for home care services through the Department of Veterans Affairs (VA). The VA’s Home Health Aide (HHA) Homemaker/Home Health Program provides up to 12 hours per week of care through community-based agencies. Eligibility criteria include specific clinical conditions or functional assessments.

Other potential funding options include:

- Reverse Mortgages: Seniors aged 62 or older who own their homes can use a reverse mortgage to access cash from their home equity. This option allows them to stay in their homes while receiving payments, but the loan balance increases over time, and the home must be sold to repay the loan upon the homeowner’s death.

- Life Insurance: Some life insurance policies can be cashed in or sold as “life settlements” to generate funds for home care.

- Long-Term Care Insurance: Individuals who purchased long-term care insurance policies may have coverage for home care services, provided they meet the policy’s requirements regarding the patient’s health needs and agency certification.

- Annuities: Annuities can provide a steady income stream that seniors can use to pay for home care expenses.

- Family Contributions: Family members often contribute financially to cover home care costs for their loved ones. The sources suggest establishing clear agreements regarding financial contributions to avoid future conflicts.

- Bridge Loans: Bridge loans offer temporary funding to cover the initial costs of home care until a more permanent funding solution is available.

- State Non-Medicaid Programs: Many states have programs that offer in-home assistance to low-income seniors who are not eligible for Medicaid. These programs aim to prevent or delay nursing home placement and may provide cash assistance, care services, respite care, or non-care support.

- Nonprofit Organizations: Some nonprofit organizations offer financial or care assistance for individuals with specific conditions, such as Alzheimer’s disease, cancer, diabetes, kidney disease, and leukemia.

Understanding Caregiver Costs

There are different types of home care and funding options available to older adults in Illinois, we can help navigate the complexities of who pays for care.

Factors Influencing Caregiver Costs

The sources highlight several key factors that influence the cost of hiring a caregiver:

- Geographic Location: Pay rates for caregivers are generally higher in urban areas compared to rural communities. Costs also tend to be higher on the East and West Coasts than in the central United States.

- Type of Care Required: Homemaker services, which involve “hands-off” care like cooking, cleaning, and companionship, typically cost less than home health aide services, which include personal care tasks such as bathing and dressing.

- Hourly Rates: Average hourly rates for in-home care aides range from $16 to $28 across the country, but these are just averages, and rates can vary significantly depending on location and other factors. In the Chicago area, costs range from $19 to $30 per hour, averaging $23.35.

- Number of Hours: The total cost of care will depend on the number of hours a caregiver is needed each day or week.

Potential Additional Costs

While hourly rates are a significant part of caregiver costs, other expenses may need to be considered, including:

- Taxes and Insurance: When hiring a contractor or independent caregiver, clients are responsible for paying all applicable taxes and insurance, including Social Security, Medicare, unemployment insurance, and workers’ compensation.

- Background Checks and Health Certificates: Agencies typically cover the costs of background checks and health certificates for their employees. However, when hiring independently, clients may incur these expenses.

- Travel Expenses: Depending on the caregiver’s location and the client’s needs, travel expenses, such as mileage reimbursement, may be an additional cost.

- Supplies and Equipment: Some caregiving tasks may require specialized supplies or equipment, which can add to the overall cost.

Financial Burden on Family Caregivers

There is significant financial burden placed on family caregivers. Family members providing care for loved ones aged 18 or older spent an average of nearly 20% of their annual income on caregiving expenses. These expenses often include transportation, home modifications, medications, assistive technology, and more.

Strategies to address the financial challenges of family caregiving:

- Collective Sibling Agreements: Siblings can collaborate to share the financial responsibility of caring for aging parents, either by directly contributing to caregiving costs or by providing financial support to siblings who act as caregivers.

- Tax Credits: The AARP supports the Credit for Caring Act, which would provide eligible family caregivers with a tax credit of up to $3,000 to help offset caregiving expenses. The credit would be available to caregivers who meet specific criteria, including earning more than $7,500 in income and providing care for a loved one with functional or cognitive limitations.

Addressing the Cost of Care

It is important to plan ahead for caregiving expenses and explore various funding options. We recommend consulting with financial advisors, elder care specialists, and veterans service organizations to determine the most appropriate and cost-effective care solutions.

Medicare Coverage for Home Healthcare

Medicare does not cover long-term care or daily in-home care. Medicare only covers part-time skilled nursing or rehabilitation care at home, and only if certain conditions are met. Medicare Part A covers this care if the patient has had a hospital stay of at least three days, while Medicare Part B covers the same care without requiring a hospital stay.

Covered Services and Supplies

The care that Medicare covers can include:

- Skilled nursing care

- Physical and speech therapy

- Medical supplies and equipment

- Occupational therapy to help the patient learn to safely perform daily personal care tasks.

Eligibility Requirements for Medicare Coverage

Medicare coverage for home healthcare is only available while a patient is actively recovering from an illness, injury, or acute condition. Once the patient’s condition stabilizes, Medicare coverage ends.

In addition, several specific conditions must be met for a patient to be eligible for Medicare Part A or Part B home care coverage:

- A doctor must prescribe part-time skilled nursing care or rehabilitative physical or speech therapy to help the patient recover.

- The patient must be “confined to home,” meaning they cannot leave home without difficulty or without assistance from another person or a medical device such as a wheelchair.

- The home healthcare must be provided by a Medicare-certified home healthcare agency. Medicare and the home care agency will regularly evaluate the patient’s condition and needs to determine how long the care is medically necessary and thus how long Medicare will cover it.

- The care must be “medically necessary.” A licensed physician or other authorized medical provider must order or prescribe it, and Medicare must agree that the care is necessary and proper. Caretakers or family members should discuss home care with the family physician to outline a care plan that Medicare will cover.

More information is available on the Medicare website.

Equipment Rental

Medicare does not cover the full cost of durable medical equipment rentals, such as wheelchairs or hospital beds. Medicare pays 80% of the rental cost for these items.

Paying for In-Home Care

As mentioned above, there are several ways to pay for in-home care, and we explain which types of care specific funding sources typically cover.

Medicare Coverage

As discussed, Medicare covers some costs associated with skilled home healthcare, but does not cover non-medical caregiving such as help with activities of daily living. To qualify for Medicare coverage, a patient must be recovering from an illness or injury, the care must be prescribed by a doctor, and the patient must be homebound. Medicare also only covers care from Medicare-certified home healthcare agencies.

Medicaid Coverage

Medicaid, which is an insurance program for low-income individuals, can cover non-medical home care, home health care, and other support services that help individuals remain in their homes. Medicaid rules and coverage for in-home care vary by state. In Illinois, the amount of care provided through Medicaid is limited, and eligibility is based on income.

Other Payment Options

The sources also offer several additional options for paying for in-home care:

- Reverse Mortgages: This option allows homeowners to convert some of their home equity into cash, which can be used to pay for in-home care. However, the loan balance accrues interest over time and must be repaid, typically by selling the home, when the homeowner dies.

- Life Insurance: The cash value of a life insurance policy can be used to pay for care. If the insurance company will not cash in the policy, it may be possible to sell the policy in a “life settlement” or “senior settlement”.

- Long-Term Care Insurance: This type of insurance is specifically designed to cover the costs of long-term care, including in-home care. However, individuals generally purchase these policies in their 50s or 60s, and they often have waiting periods before benefits become available. When selecting a long-term care insurance policy, you should prioritize plans that offer flexibility in how you can use the daily care benefit amount.

- Annuities: Annuities provide a steady stream of income that can be used to pay for care. The amount invested in an annuity is not counted as an asset when applying for Medicaid, but the income paid out from the annuity is counted.

- Collective Sibling Agreements: Family members can create an agreement to share the costs of care. This may involve siblings contributing financially to cover caregiving expenses or providing financial support to a sibling who acts as the primary caregiver. Any agreements of this nature should be carefully documented to avoid conflict later on.

- Bridge Loans: A bridge loan is a short-term loan designed to cover care costs until a more permanent funding source becomes available.

- State Non-Medicaid Programs: Many states offer in-home assistance programs for low-income seniors who are not eligible for Medicaid. These programs vary in their eligibility requirements, benefits, and funding sources, but are generally designed to prevent or delay the need for nursing home care.

- Non-profit Organizations: Some non-profit organizations offer financial or care assistance to individuals with certain health conditions, such as Alzheimer’s disease, cancer, diabetes, kidney disease, and leukemia.

Paying for Veteran’s Home Care

The U.S. Department of Veterans Affairs (VA) offers a Home Health Aide (HHA) Homemaker/Home Health Program which provides eligible veterans up to 12 hours per week of in-home care. To qualify for this program, a veteran must have specific clinical conditions and functional limitations, such as three or more dependencies in activities of daily living (ADLs) or significant cognitive impairment. Eligibility for this benefit is also subject to asset limits and proof of financial need. You should be aware that according to the Senior Veterans Service Alliance, many eligible veterans do not take advantage of this benefit.

Tax Credits for Caregivers

As previously mentioned, AARP is advocating for the passage of the Credit for Caring Act. This proposed federal legislation would provide a non-refundable tax credit of up to $3,000 to working family caregivers who financially assist loved ones who need care.

Future of Home Care in Illinois

Growing Demand

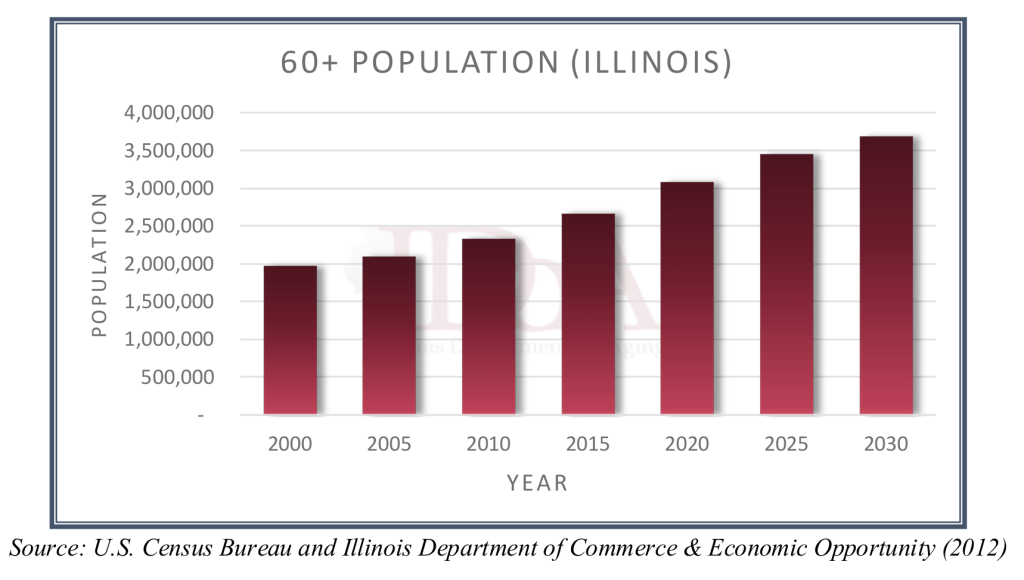

The IL government sources predict a significant increase in the need for home care services in Illinois in the coming years. The number of individuals aged 60 and older in Illinois is projected to increase to 3.6 million by 2030. This growth is largely attributed to the aging of the baby boomer generation. As this population ages, the demand for services and supports that allow them to remain in their homes will increase. This anticipated growth in the aging population poses challenges for the current senior care system in Illinois.

The sources also point to a growth in demand for services for older adults over the age of 85. This population is expected to grow to more than 400,000 by 2030. This growth presents a particular challenge because individuals in this age group often have more complex care needs, potentially requiring a higher level of skilled care and support.

Addressing Home Care Challenges and Opportunities in Illinois

There are several challenges and opportunities in the realm of home care:

- Workforce Shortages: The growing demand for home care services is creating a need for a larger and more skilled workforce. Illinois is pursuing strategies to develop workforce pipelines, including partnerships with educational institutions and workforce development programs.

- Integration of Medical and Social Needs: The sources emphasize the importance of coordinating medical and social services to provide holistic care for older adults. Illinois is working to integrate Aging network providers into the healthcare environment and collaborate with Managed Care Organizations (MCOs) to align and expand long-term services and supports.

- Technology Advancements: Technology plays an increasing role in home care, from assistive technology for ADLs to telehealth platforms for remote monitoring and communication. Illinois is exploring ways to provide older adults and their caregivers with easy-to-use and cost-effective technology solutions.

- Access to Affordable Housing: The sources highlight the need for accessible, safe, and affordable housing options that allow older adults to age in place. Illinois is participating in statewide working groups and collaborating with various agencies to address housing needs and support the development of affordable and supportive housing options.

- Transportation Barriers: Access to reliable transportation is crucial for older adults to maintain their independence and participate in community life. Illinois is evaluating transportation options, coordinating with various agencies, and seeking solutions to eliminate barriers to adequate transportation services.

- Support for Caregivers: The sources recognize the significant demands placed on caregivers and the need for programs that provide respite, training, and emotional support. Illinois is expanding caregiver support programs, establishing workgroups to identify caregiver needs, and promoting trauma-informed care and burnout prevention training.

Assisting Hands Home Care is a licensed home care agency that provides a wide range of services for seniors, expectant mothers and adults with limitations in Schaumburg, IL | Elk Grove Village, IL | Rolling Meadows, IL | Des Plaines, IL | Palatine, IL | Hoffman Estates, IL | Inverness, IL | Niles, IL | | Park Ridge, IL | Chicago, IL | Norridge, IL | Harwood Heights, IL. Contact us for help!

Daniela has master’s degree in electronic engineering with a pedagogical specialty and master’s degree in marketing management.

After completing her schooling, Daniela worked at a hospital for 6 years as the Director of Business Marketing Development and Public Relations.

Starting Assisting Hands Home Care

Daniela spent more than 14 years as the Assistant Vice President of a national bank before becoming a co-owner of Assisting Hands Home Care of Schaumburg.

Her background in public relations and marketing along with her personal experience caring for her mother motivates Daniela to be passionate about helping families in the Schaumburg, IL area find exceptional caregiving services for their elderly loved ones.

Besides providing home care, Daniela enjoys giving back to the community in her free time, supporting various events at St. Peter Parish in Geneva, IL such as fundraising, school projects, charity events, and more. She also enjoys volunteering for the Humanitarian Service Project in Carol Stream, IL. This organization provides seniors with meals as well as food and supplies for children living in poverty.