In 2022, there were 57.8 million people in the United States who were 65 or older, which was 17.3% of the population. This is more than one in every six Americans. The number of people in this age group has increased by 34% since 2012. The population of people 65 and older is expected to continue to grow in the coming decades. By 2054, it’s estimated that 84 million people will be 65 or older, which will be 23% of the population.

At least 70 percent of these people will require some long-term care; and most of today’s seniors would prefer home care. This may explain why as the baby boomer generation continues to age, the need for cost-effective, in-home caregivers is also expected to grow.

Understanding home healthcare (medical) vs in home care (caregiver)

Home health care includes occupational & physical therapy, speech therapy, and skilled nursing, it is prescribed by a physician and is medical in nature. For example, intubation and wound care. Health insurance such as Medicare and insurance is generally the payor for this service.

In-home caregiving is non-medical in nature and may involve helping older adults with activities of daily living, like bathing, dressing, and eating. It can also include assistance with cooking, cleaning, other housekeeping, and monitoring one’s medication routine. Health insurance does not pay for these activities and costs are generally self-pay.

It is important to understand that while physician care is critical, seniors need continued supervision at home, especially if family caregivers can’t always be present. This care may include private duty professional caregivers who work in the home, nursing aides, homemakers, and companions.

In-home caregivers are typically Certified Nursing Assistants (CNA’s) and complete an 8-week certification program. Illinois requires 8 hours of initial caregiving training as well, which includes Home Safety Evaluation, Infection Control and Universal Precaution, Types of Disabilities, transferring a client, Assisting with Personal Care, Diets, Meal Planning and nutrition.

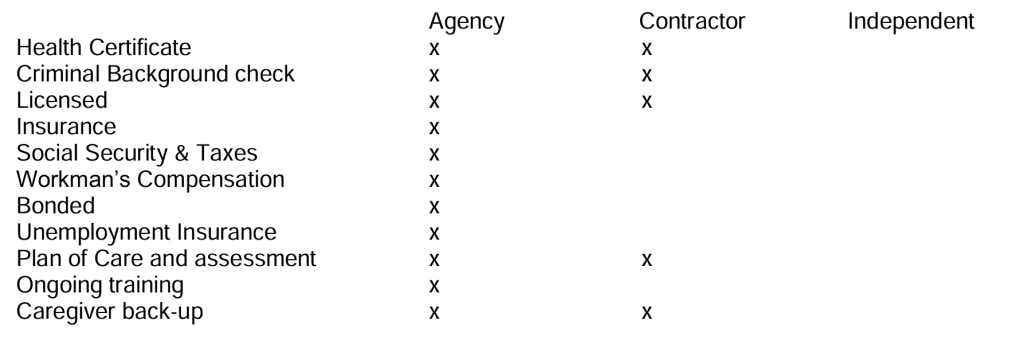

Understanding AGENCY, CONTRACTOR (Registry) and Independent Caregivers

Full service home care agencies screen, hire, train and supervise their employees, ensuring quality in-home care. Contractors (registry) and Independent caregivers do not hire caregivers and as a result clients are responsible for all taxes and insurances.

The economics of home care

The cost of home care depends on where you live. In general, pay rates in urban areas are higher than in rural communities and still higher on the east and west coasts than in the central United States. Costs also depend on whether you’re looking for homemaker services — defined as “hands-off” care, such as cooking, cleaning, running errands, and general companionship — or home health aide services, which include personal care, such as bathing and dressing.

According to Paying for Senior Care, nationwide, in 2024, the average cost for non-medical home care is $28.41 per hour, with the state averages ranging from $21 – $35 per hour. It should be noted that these are average costs from home care agencies. Private individuals can be retained to provide most of the same services with fees that are 20% – 30% lower. However, independent caregivers are typically uninsured, do not go through background checks and may be unable to provide alternatives in case they are not available to work on short notice.

Home health aides visit the home as much as medically necessary, typically for shorter periods of time than home care aides. In 2024, nationwide, the average hourly fee is $29.50. Different state averages range from $21 to $38 per hour. In Illinois the average hourly cost of home care aides is $30.60.

Alzheimer’s care at home can be affordable and relatively low cost when compared to residential care. Typically, home care providers do not charge extra fees to care for individuals with Alzheimer’s. This is not the case in senior living residences, where Alzheimer’s and dementia care usually costs an additional $800 – $1,200 per month.

Who makes home care decisions?

a) Family Members

Family caregivers take on huge responsibilities that can be overwhelming, stressful and exhausting — not to mention challenging financially. Many juggle family caregiving duties while working full- or part-time jobs; some are still raising families. Those caring for loved ones 18 and older spent an average of nearly 20 percent of their annual income on caregiving expenses.

Family caregivers play a key role in delaying and possibly preventing institutionalization of chronically ill elderly patients. Although neighbors and friends may help, about 80% of help in the home (physical, emotional, social, economic) is provided by family caregivers. When the patient is mildly or moderately impaired, a spouse or adult children often provide care, but when the patient is severely disabled, a spouse (usually a wife) is more likely to be the caregiver.

According to data from the National Alliance for Caregiving and AARP, approximately 41.8 million Americans provide unpaid care to an adult aged 50 or older, representing nearly 17% of the U.S. adult population.

b) Agents Under a Power of Attorney

A power of attorney is designated for family and friends who have been named by loved ones to make financial decisions on their behalf in a legal document, known as a Power of Attorney. People often make these arrangements so someone they trust can handle their finances if they become sick or injured and are unable to do so themselves. The power of attorney can be revoked at any time your loved one wants as long as he or she is still able to make decisions. The guide explains what you can and cannot do as an agent. It outlines the importance of careful money management, keeping your money separate and maintaining good records.

c) Court-appointed guardians

If a court finds that someone cannot manage his or her money and property alone, it can hold a hearing and name a guardian or conservator. As guardian of property, a person has a double duty: to the protected person being served and to the court. Any court-appointed guardian must make decisions in your loved one’s best interest and report regularly to the court. Guardians must understand the court order, avoid conflicts of interest and keep their loved one’s money and property protected.

d) Trustees

Trustees are named under a revocable living trust. The arrangement transfers ownership of some or all of a loved one’s money and property from his or her name to the name of the trust. The law places a lot of responsibility on a trustee. The trustee must keep the trust’s property safe, which may include putting valuables in safe deposit boxes, maintaining insurance and paying taxes. Trustees also must make careful investment decisions with a loved one’s assets. The trustee has the authority over property actually transferred to the trust and only after a loved one has lost the capacity to manage his or her property. As long as the loved one can still make decisions and the terms of the trust allow it, he or she can change or end the trust.

e) Government fiduciaries

A government agency may appoint someone to manage income benefits for a person who needs assistance. If a person is managing benefits from the Social Security Administration or the Department of Veterans Affairs, as a rep payee or VA fiduciary, the authority is limited to managing the benefit checks of the agency appointing a manager. To manage other money or property of a loved one, a government appointed manager must have legal authority through a power of attorney, trust or court appointment.

What does Medicare cover and why doesn’t insurance pay for caregivers?

Medicare Part A covers part-time skilled nursing or rehabilitation care at home following a patient’s hospital stay of at least three days. Medicare Part B covers the same care with no hospital-stay requirement. The care can include skilled nursing care and physical and speech therapy, as needed, along with medical supplies and equipment, as well as an occupational therapist to help the patient learn how to safely accomplish daily personal care. Medicare home care coverage is available only while a patient is actually recovering from an illness, condition, or injury. Once the patient’s condition has stabilized, Medicare home care coverage ends. Medicare doesn’t cover care needed because of a long-term condition or general frailty, and Medicare doesn’t cover full-time or daily in home care. Also exempted is the rental cost of durable medical equipment such as a wheelchair or hospital bed, for which Medicare pays 80 percent.

Medicare Part A or Part B home care coverage is available only under several conditions:

- The patient must need, and a doctor must prescribe, part-time skilled nursing care or rehabilitative physical or speech therapy to help the patient recover from an illness, injury, or acute condition.

- At-home care is available only if a patient is “confined to home” (though not necessarily bedridden). This means unable to leave home without difficulty and without the help of another person or a medical device such as a wheelchair.

- Home Health care must be provided by a Medicare-certified home healthcare agency. There is no specific limit on how many home care visits Medicare will cover. The home care agency and Medicare regularly evaluate a patient’s condition and needs to determine how long the care is medically needed and thus how long Medicare will continue coverage.

- The care must be “medically necessary.” This means that it must be ordered or prescribed by a licensed physician or other authorized medical provider, and that Medicare (or a Medicare Part C plan) agrees that the care is necessary and proper. This requires caretakers or family members to discuss home care with the family physician to outline a care plan that will be covered by Medicare.

Daniela has master’s degree in electronic engineering with a pedagogical specialty and master’s degree in marketing management.

After completing her schooling, Daniela worked at a hospital for 6 years as the Director of Business Marketing Development and Public Relations.

Starting Assisting Hands Home Care

Daniela spent more than 14 years as the Assistant Vice President of a national bank before becoming a co-owner of Assisting Hands Home Care of Schaumburg.

Her background in public relations and marketing along with her personal experience caring for her mother motivates Daniela to be passionate about helping families in the Schaumburg, IL area find exceptional caregiving services for their elderly loved ones.

Besides providing home care, Daniela enjoys giving back to the community in her free time, supporting various events at St. Peter Parish in Geneva, IL such as fundraising, school projects, charity events, and more. She also enjoys volunteering for the Humanitarian Service Project in Carol Stream, IL. This organization provides seniors with meals as well as food and supplies for children living in poverty.